Business

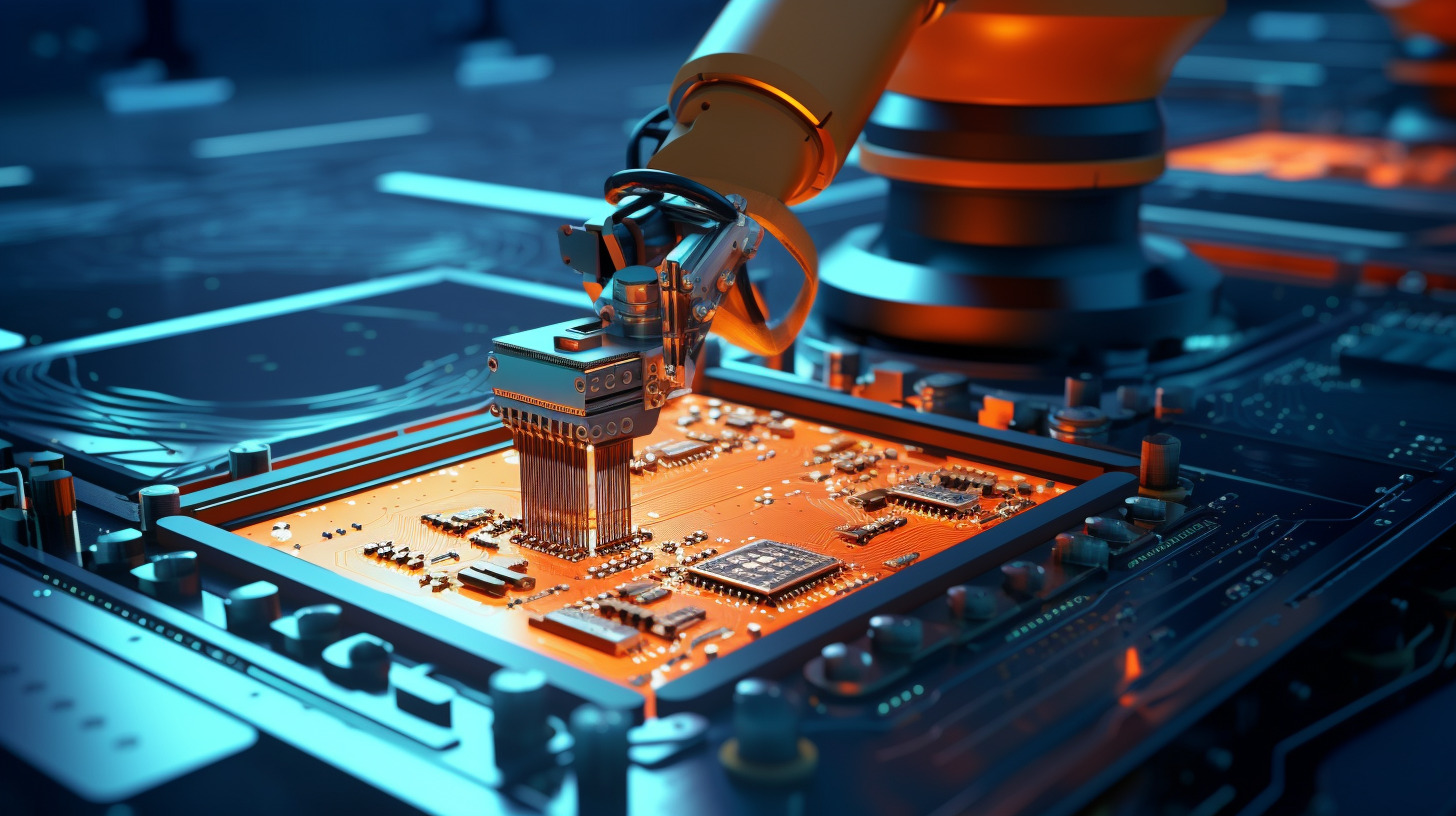

Texas Instruments Faces Demand Challenges Amid Market Rally

The semiconductor manufacturer Texas Instruments Incorporated (NASDAQ:TXN) experienced a decline in its stock value, reflecting slower-than-expected demand recovery in its core industrial and automotive markets. This was highlighted in the third-quarter 2025 investor letter from Diamond Hill Capital, an investment management firm that oversees the Diamond Hill Large Cap Fund.

According to the letter, which was released in early November, the broader market continued its upward momentum in the third quarter, with the Russell 3000 Index gaining 8% and bringing year-to-date returns to over 14%. In contrast, the Diamond Hill Large Cap Fund underperformed, with its portfolio declining during the same period. As of November 6, 2025, Texas Instruments closed at $161.38 per share, with a market capitalization of approximately $146.634 billion. Over the past year, the company’s stock has decreased by 26.74%, with a one-month return of -6.01%.

In its analysis, Diamond Hill Capital noted that alongside Texas Instruments, other underperformers included American International Group (AIG) and Colgate-Palmolive. The firm stated, “Shares of semiconductor manufacturer Texas Instruments declined as demand in its core industrial and automotive end markets has recovered slower than expected. However, we maintain our conviction in the company’s competitive advantages in manufacturing, product breadth and direct distribution, and anticipate these headwinds will be short term.”

Despite the recent challenges, Texas Instruments reported revenue of $4.7 billion for the third quarter, aligning closely with market expectations. This figure represented a sequential increase of 7% and a year-over-year increase of 14%. While the firm recognizes the investment risks associated with Texas Instruments, it expressed a belief that other stocks, particularly those related to artificial intelligence, may offer greater potential for higher returns within a shorter timeframe.

At the end of the second quarter, 68 hedge fund portfolios included Texas Instruments, down from 69 in the previous quarter. The company is not featured on the list of the 30 most popular stocks among hedge funds, indicating a potential shift in investor sentiment.

As markets continue to evolve, investors may want to consider various factors when evaluating stocks like Texas Instruments. The semiconductor industry remains critical to technological advancement, but recent demand fluctuations may require a reevaluation of growth potential.

For those interested in further insights, Diamond Hill Capital has provided additional resources and investor letters pertaining to the third quarter of 2025, which can be accessed through their official channels.

In summary, while Texas Instruments navigates current market challenges, its long-term competitive advantages may still position it favorably in an evolving landscape, particularly as demand dynamics shift in key sectors.

-

Science3 weeks ago

Science3 weeks agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

World3 weeks ago

World3 weeks agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Politics3 weeks ago

Politics3 weeks agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

Health3 weeks ago

Health3 weeks agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Health3 weeks ago

Health3 weeks agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

Top Stories3 weeks ago

Top Stories3 weeks agoIndonesia Suspends 27,000 Bank Accounts in Online Gambling Crackdown

-

Sports3 weeks ago

Sports3 weeks agoMel Kiper Jr. Reveals Top 25 Prospects for 2026 NFL Draft

-

Science3 weeks ago

Science3 weeks agoArizona State University Transforms Programming Education Approach

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

World3 weeks ago

World3 weeks agoHoneywell Predicts Record Demand for Business Jets Over Next Decade

-

Sports3 weeks ago

Sports3 weeks agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2