Health

Simplifying Medicare Choices for Millions of Older Adults

Nearly 69 million Americans aged 65 and older, as well as those with disabilities, rely on Medicare for their health insurance. Starting from October 11, 2023, these beneficiaries will face an overwhelming influx of mail from insurance companies during the eight-week enrollment period for 2026. This annual event prompts many to reassess their health coverage, yet a significant number typically do not take action.

Research indicates that while switching plans could save beneficiaries hundreds, or even thousands, of dollars annually, most remain inactive. A survey conducted by the Kaiser Family Foundation revealed that nearly 70% of Medicare beneficiaries did not compare available plans for their 2022 coverage. Similarly, a study by the USC Schaeffer Institute found that around half of those with stand-alone prescription drug plans did not explore alternative options for 2024.

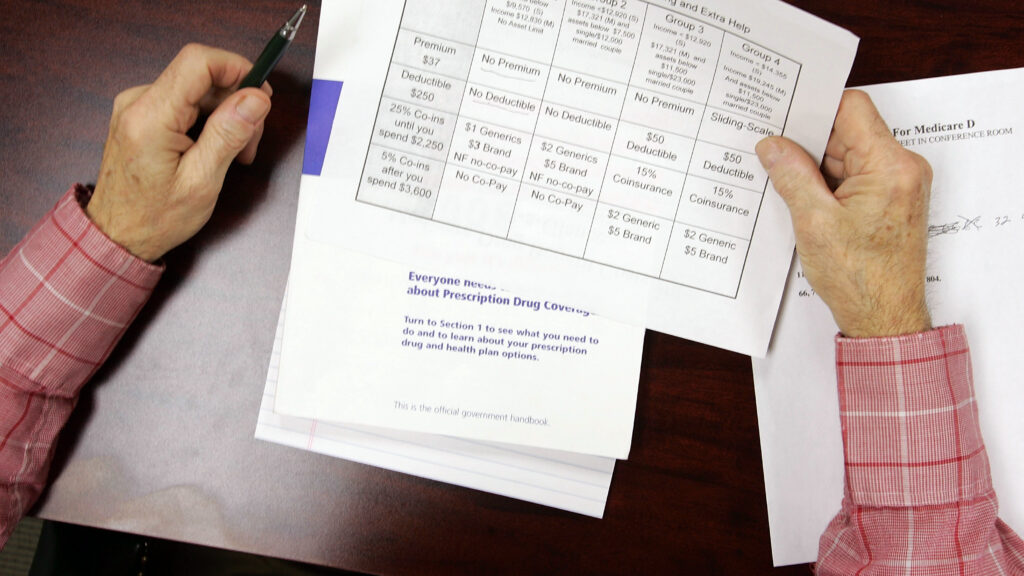

The complexity of Medicare can be daunting. The program consists of various parts: Part A covers hospital visits, Part B encompasses doctors’ services, and Part D provides prescription drug coverage. Many beneficiaries opt for a Medicare Advantage Plan (Part C), which combines coverage options. Each plan differs significantly in terms of premiums, deductibles, copays, and covered services.

In practice, beneficiaries face a staggering average of 48 plans to evaluate for 2025, including 14 Part D plans and 34 Medicare Advantage plans. This abundance of choices, while theoretically beneficial, often leads to confusion. The Centers for Medicare and Medicaid Services recently announced that even more options will be available for 2026, compounding the dilemma for many older adults.

The intention behind offering multiple plans is rooted in the principles of rational choice theory, which posits that more options should lead to better selections tailored to individual health needs. However, most beneficiaries struggle to predict their healthcare requirements for the following year. One participant in a USC study expressed their frustration: “I have no basis, none whatsoever, on which to base a decision.” Consequently, many beneficiaries continue to be automatically reenrolled in their existing plans, even as insurers frequently modify terms and costs.

This past year was particularly challenging for beneficiaries, as many Part D plans increased deductibles and costs for commonly prescribed medications due to changes enacted by the Inflation Reduction Act. Those who do not switch plans are less likely to be enrolled in the most financially suitable option for their medications. Beneficiaries who actively compare plans tend to be more informed and often utilize the Medicare Part D plan finder or consult with advisers. Yet, navigating these resources can be difficult, especially for older individuals who may not be comfortable with online tools.

Policymakers can take significant steps to simplify the process for Medicare beneficiaries. Efforts could include further limiting the number of plans offered by individual insurers and discouraging low-enrollment duplicate plans. Standardizing plan features would also facilitate easier comparisons, allowing beneficiaries to make informed choices. Additionally, allowing individuals to remain with their selected plan for longer periods without changes could reduce the frequency of decision-making stress.

There have been calls to prevent automatic reenrollment, particularly when there are substantial cost increases. Addressing these concerns requires careful consideration of how to assign beneficiaries to more suitable plans.

Navigating Medicare should not add to the anxiety already associated with health challenges. Seniors deserve straightforward options that allow them to focus on their health rather than on complex insurance decisions. For those in need of assistance, contacting the local State Health Insurance Assistance Program can provide access to unbiased advisers who can help clarify choices.

In conclusion, addressing the complexities of Medicare is essential for supporting the well-being of older adults. As highlighted by Wändi Bruine de Bruin and Jonathan Blum of the USC Schaeffer Institute, simplifying these choices can significantly enhance the experience for millions of beneficiaries navigating their healthcare needs.

-

Science2 weeks ago

Science2 weeks agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Politics2 weeks ago

Politics2 weeks agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

World2 weeks ago

World2 weeks agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Top Stories2 weeks ago

Top Stories2 weeks agoIndonesia Suspends 27,000 Bank Accounts in Online Gambling Crackdown

-

Sports2 weeks ago

Sports2 weeks agoMel Kiper Jr. Reveals Top 25 Prospects for 2026 NFL Draft

-

Health2 weeks ago

Health2 weeks agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Health2 weeks ago

Health2 weeks agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

World2 weeks ago

World2 weeks agoHoneywell Predicts Record Demand for Business Jets Over Next Decade

-

Politics2 weeks ago

Politics2 weeks agoNew Jersey Voters Urged to Register Ahead of November Election

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

Sports2 weeks ago

Sports2 weeks agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2