Science

High-Temperature Weather Insights Transform Oil Price Forecasting

Forecasting oil prices has become more precise with the introduction of a new analytical model developed by researchers from the College of Economics and Management and the Research Centre for Soft Energy Science at Nanjing University of Aeronautics and Astronautics. Their study, titled “Can extremely high-temperature weather forecast oil prices?” focuses specifically on the China International Energy Exchange (INE) crude oil futures market, aiming to improve decision-making for enterprises and managing investor risk.

Traditional forecasting methods, including both statistical and machine learning models, have significant limitations. Standard statistical approaches often overlook the nonlinearity of oil prices, while machine learning models frequently lack interpretability. Additionally, few of these models integrate critical meteorological data, even though extreme temperatures can disrupt oil supply chains—affecting drilling, refining, and transportation—and increase demand for cooling energy.

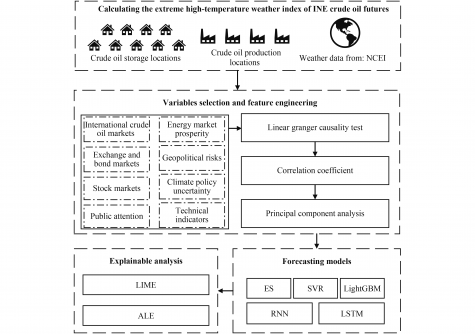

Recognizing these gaps, the research team developed an Extreme High-Temperature Weather Index (HTI). This index uses meteorological data sourced from INE’s production and storage sites, specifically targeting the 85th percentile historical temperature threshold and applying site-specific weighting. By incorporating the HTI into five different forecasting models—exponential smoothing, support vector regression (SVR), LightGBM, long short-term memory (LSTM), and recurrent neural networks (RNN)—the researchers aimed to enhance predictive accuracy.

Methodology and Findings

To optimize their forecasting variables, the team employed Granger tests and principal component analysis (PCA). They also utilized LIME (Local Interpretable Model-agnostic Explanations) and ALE (Accumulated Local Effects) to enhance the interpretability of their results. The findings indicate that the RNN model, when integrated with the HTI, achieved the best performance metrics, registering a mean absolute error (MAE) of 14.379, a root mean square error (RMSE) of 19.624, and a directional accuracy score (DS) of 66.67%.

The study illustrates that including the HTI improves the accuracy of all models tested. Notably, LIME analysis revealed that the HTI ranks third in predictive importance, surpassing the CSI300 index. The ALE analysis confirmed a positive correlation between the HTI and INE prices, suggesting that higher temperatures could lead to increased oil prices due to elevated demand.

This innovative research could reshape how stakeholders in the oil market approach pricing strategies, particularly in the context of climate variability. The complete study is authored by Donglan ZHA, Shuo ZHANG, and Yang CAO, and is available for further reading at https://doi.org/10.1007/s42524-025-4075-5 in the journal Frontiers in Engineering Management.

By advancing oil price forecasting methodologies, this research not only addresses existing flaws in traditional models but also emphasizes the importance of integrating climatic factors into financial decision-making processes. As global temperatures continue to rise, the implications of such findings will be crucial for both investors and companies operating in the energy sector.

-

Science2 weeks ago

Science2 weeks agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Politics2 weeks ago

Politics2 weeks agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

World2 weeks ago

World2 weeks agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Top Stories2 weeks ago

Top Stories2 weeks agoIndonesia Suspends 27,000 Bank Accounts in Online Gambling Crackdown

-

Health2 weeks ago

Health2 weeks agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Sports2 weeks ago

Sports2 weeks agoMel Kiper Jr. Reveals Top 25 Prospects for 2026 NFL Draft

-

Health2 weeks ago

Health2 weeks agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

World2 weeks ago

World2 weeks agoHoneywell Predicts Record Demand for Business Jets Over Next Decade

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

Sports2 weeks ago

Sports2 weeks agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2

-

Politics2 weeks ago

Politics2 weeks agoNew Jersey Voters Urged to Register Ahead of November Election