Top Stories

Nvidia’s Blockbuster Earnings Ignite Tech Stocks, Reassure AI Investors

UPDATE: Nvidia’s stunning third-quarter earnings are sending shockwaves through the stock market, revitalizing investor confidence in the artificial intelligence (AI) sector. Just reported, Nvidia posted a remarkable $57 billion in revenue, a staggering 62% year-over-year increase, leading tech stocks to surge immediately.

The announcement came on October 19, 2023, and investors reacted positively, with Nvidia’s shares jumping 5%. Other tech giants are also reaping the benefits: Super Micro Computer soared 6.4%, Advanced Micro Devices climbed 4.6%, and Broadcom increased 3.3%. Major indexes experienced significant gains, with the Nasdaq leading the charge, up more than 2%.

At the opening bell at 9:30 a.m. on Thursday, the U.S. indexes stood as follows:

– S&P 500: 6,742.50, up 1.5%

– Dow Jones Industrial Average: 46,637.69, up 1.13% (+521 points)

– Nasdaq Composite: 23,037.78, up 2%

Nvidia’s performance has revived a tech sector that had been struggling, as fears of an AI bubble loomed large among investors. Analysts were worried about high valuations and increasing capital expenditure directed toward AI initiatives. However, Nvidia’s results have calmed many concerns, affirming that demand for AI chips remains robust.

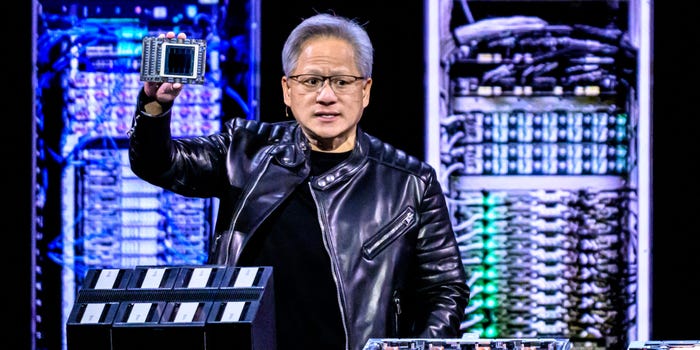

Nvidia’s data center business also thrived, generating $51.2 billion, reflecting a 66% year-over-year increase. CEO Jensen Huang has positioned Nvidia as a cornerstone of the AI revolution, describing its performance as pivotal for the market.

David Rosenberg, a leading economist, stated, “It has been many decades since one stock could move the market like Nvidia.” His note emphasized that Nvidia’s results have ended a period of stagnation, giving the market a much-needed boost.

Dan Ives, an analyst at Wedbush Securities, asserted, “In a nutshell, there is one company in the world that is the foundation for the AI Revolution, and that is Nvidia.” Ives highlighted the significance of Huang’s comments, which resonated strongly with tech investors eager for reassurance.

Despite the renewed optimism, some analysts, including Rosenberg, caution against complacency. He voiced skepticism about the sustainability of the AI market’s explosive growth, stating, “This remains a bubble of epic proportions.” He warned that the projected eightfold expansion in the AI sector over the next five years may not be realistic.

As the market reacts to Nvidia’s performance, all eyes will be on upcoming earnings reports from other tech firms, which could further shape the landscape of the AI trade. Investors are urged to stay vigilant as the potential for market volatility remains, despite the current surge in confidence.

Stay tuned for more updates as this story develops and further earnings reports are released. The tech sector’s future hinges on these critical developments.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi at Mānoa Joins $25.6M AI Initiative for Disaster Monitoring

-

Science2 months ago

Science2 months agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Red Giant Star π 1 Gruis

-

Lifestyle2 months ago

Lifestyle2 months agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Health2 months ago

Health2 months agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

World2 months ago

World2 months agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Lifestyle2 months ago

Lifestyle2 months agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

Politics2 months ago

Politics2 months agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

Health2 months ago

Health2 months agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

Sports2 months ago

Sports2 months agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2

-

Science2 months ago

Science2 months agoArizona State University Transforms Programming Education Approach

-

Business2 months ago

Business2 months agoTruist Financial Increases Stake in Global X Variable Rate ETF