Top Stories

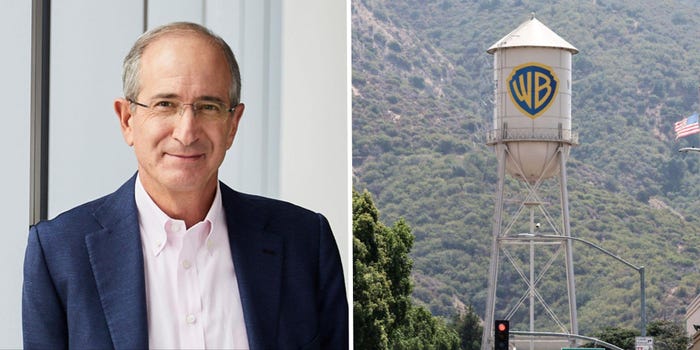

Comcast’s Urgent Bid for Warner Bros. Discovery Heats Up

UPDATE: A fierce bidding war for Warner Bros. Discovery (WBD) is igniting, with Comcast emerging as a leading contender against industry giants Paramount and Netflix. Analysts stress that Comcast’s co-CEO Brian Roberts may be the most motivated to secure this acquisition, which could significantly reshape the media landscape.

The urgency is palpable as the battle for WBD escalates. With October 2023 proving pivotal, industry experts suggest Comcast views this as a once-in-a-generation opportunity to transform its streaming narrative. According to Rich Greenfield of LightShed Partners, acquiring WBD would not only enhance Comcast’s offerings but could also challenge the dominance of Disney.

Comcast’s flagship streaming service, Peacock, has stagnated at 41 million subscribers for three consecutive quarters. In contrast, Paramount+ has surged to 79.1 million subscribers, marking a critical gap that WBD’s assets could fill. Analysts like Brandon Katz from Greenlight Analytics emphasize that integrating HBO Max with Peacock could drive unprecedented growth.

Industry insiders believe that the synergy between HBO Max and Peacock is significant, with only 20% of HBO Max subscribers also using Peacock. This limited overlap could lead to enhanced revenue through a bundled offering, making the acquisition even more appealing for Comcast. Veteran analyst Craig Moffett highlights that HBO Max is the “most obvious partner” for Peacock, which is currently underperforming in the competitive streaming market.

Despite Comcast’s ambitions, challenges loom ahead. The company’s stock performance has been lackluster, and regulatory hurdles could complicate the acquisition process. Moffett warns that past tensions between Comcast and political figures, including former President Donald Trump, could impact regulatory approval. However, there is speculation that Comcast may navigate these waters by addressing potential antitrust concerns.

The stakes are high as Comcast seeks to avoid leaving Peacock “stranded” without a robust content partner. Analysts believe that with strategic maneuvering, Comcast could secure WBD and reinvigorate its streaming ambitions, particularly in light of its recent investments in sports media rights.

As the bidding war intensifies, the industry is watching closely. Will Comcast make a bold move to change the streaming landscape? Stay tuned for updates on this developing story, as the implications of this acquisition could redefine competition in the media space.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi at Mānoa Joins $25.6M AI Initiative for Disaster Monitoring

-

Science2 months ago

Science2 months agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Science2 weeks ago

Science2 weeks agoALMA Discovers Companion Orbiting Red Giant Star π 1 Gruis

-

Lifestyle2 months ago

Lifestyle2 months agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Health2 months ago

Health2 months agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Lifestyle2 months ago

Lifestyle2 months agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

World2 months ago

World2 months agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Politics2 months ago

Politics2 months agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

Health2 months ago

Health2 months agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

Sports2 months ago

Sports2 months agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2

-

Science2 months ago

Science2 months agoArizona State University Transforms Programming Education Approach

-

Business2 months ago

Business2 months agoTruist Financial Increases Stake in Global X Variable Rate ETF