Business

Bank of Canada Lowers Rates to 2.25% Amid Weak Growth Signals

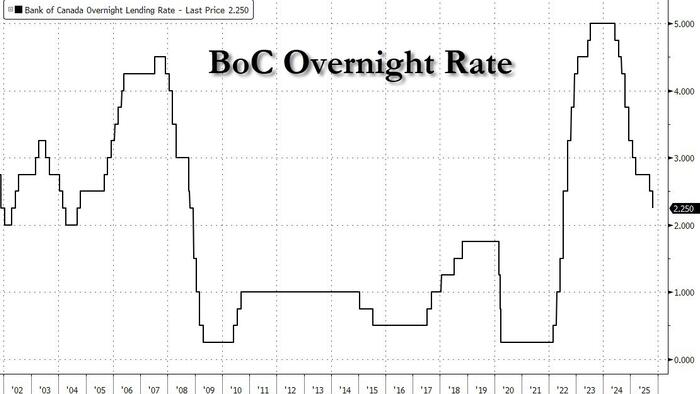

The Bank of Canada (BoC) has reduced its key interest rate by 25 basis points to 2.25%, responding to signs of weak economic growth. The move aligns with expectations and aims to keep inflation near the central bank’s target of 2% while aiding the economy during a phase of structural adjustment. This decision comes in light of a reported contraction of 1.6% in Canada’s economy during the second quarter, compounded by ongoing uncertainties in the global trade environment, particularly with the United States.

In its official statement, the BoC highlighted that the trade dispute with the US is expected to contribute to subdued growth in the latter half of the year. Despite this, the central bank noted that consumer and government spending, along with a potential recovery in exports and business investment, could help stimulate economic activity. However, the labour market remains fragile, with job losses accumulating in sectors sensitive to trade fluctuations.

Economic Outlook and Risks

The BoC’s assessment indicates that US tariffs and unpredictable trade policies are exerting significant pressure on the Canadian economy. Tiff Macklem, Governor of the Bank of Canada, remarked on the challenges posed by the ongoing trade tensions, stating that these factors are contributing to a structural transition rather than a simple cyclical downturn. He emphasized the need for caution, acknowledging that the range of potential economic outcomes is broader than usual due to these uncertainties.

According to the Bank’s latest Monetary Policy Report (MPR), the global economy is projected to slow from approximately 2% in 2025 to around 3% in 2026 and 2027. The BoC anticipates that employment will remain weak, with the unemployment rate holding steady at 7.1% in September. Despite expectations for gradual GDP growth to resume, it is forecasted to average about 0.75% in the near term, with a potential increase to 1.5% by 2027 as economic conditions improve.

The Governor reiterated that the current policy rate is deemed appropriate to support inflation control while assisting the economy through this adjustment period. The BoC is prepared to modify its approach as economic data evolves, reflecting a commitment to remain responsive to changing circumstances.

Market Reactions

The market response to the announcement was muted, as the rate cut had been anticipated. Following the BoC’s decision, the USD/CAD exchange rate initially dipped from 1.3929 to 1.3916 before stabilizing around 1.3925. This indicates that traders had largely priced in the cut and were awaiting further signals regarding the central bank’s future policy direction.

In summary, the Bank of Canada’s latest rate adjustment reflects an ongoing struggle to navigate a challenging economic landscape marked by external pressures and domestic vulnerabilities. As the central bank continues to monitor the evolving situation, its actions will be critical in shaping the future trajectory of Canada’s economy.

-

Science2 weeks ago

Science2 weeks agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Politics2 weeks ago

Politics2 weeks agoJudge Considers Dismissal of Chelsea Housing Case Citing AI Flaws

-

World2 weeks ago

World2 weeks agoBravo Company Veterans Honored with Bronze Medals After 56 Years

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Health2 weeks ago

Health2 weeks agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Top Stories2 weeks ago

Top Stories2 weeks agoIndonesia Suspends 27,000 Bank Accounts in Online Gambling Crackdown

-

Health2 weeks ago

Health2 weeks agoTop Hyaluronic Acid Serums for Radiant Skin in 2025

-

Sports2 weeks ago

Sports2 weeks agoMel Kiper Jr. Reveals Top 25 Prospects for 2026 NFL Draft

-

World2 weeks ago

World2 weeks agoHoneywell Predicts Record Demand for Business Jets Over Next Decade

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

Sports2 weeks ago

Sports2 weeks agoYamamoto’s Mastery Leads Dodgers to 5-1 Victory in NLCS Game 2

-

Politics2 weeks ago

Politics2 weeks agoNew Jersey Voters Urged to Register Ahead of November Election