Business

Wall Street Analysts Unite for Optimistic 2026 Outlook on S&P 500

Recent reports indicate an unusual consensus among Wall Street analysts regarding the outlook for the S&P 500 in 2026. A comprehensive survey of major brokerage estimates compiled by Bloomberg reveals that not a single strategist predicts a downturn for the index in the upcoming year. This rare unanimity provides investors with a clear framework to consider as they navigate the market landscape.

While this consensus does not imply immediate challenges, it offers investors a base case to evaluate future performance. Rather than viewing the agreement as a potential warning, it should be seen as a blueprint for understanding the conditions necessary for a market upswing. Analysts from CFRA emphasize the importance of this shared outlook, noting several key factors that could shape market performance.

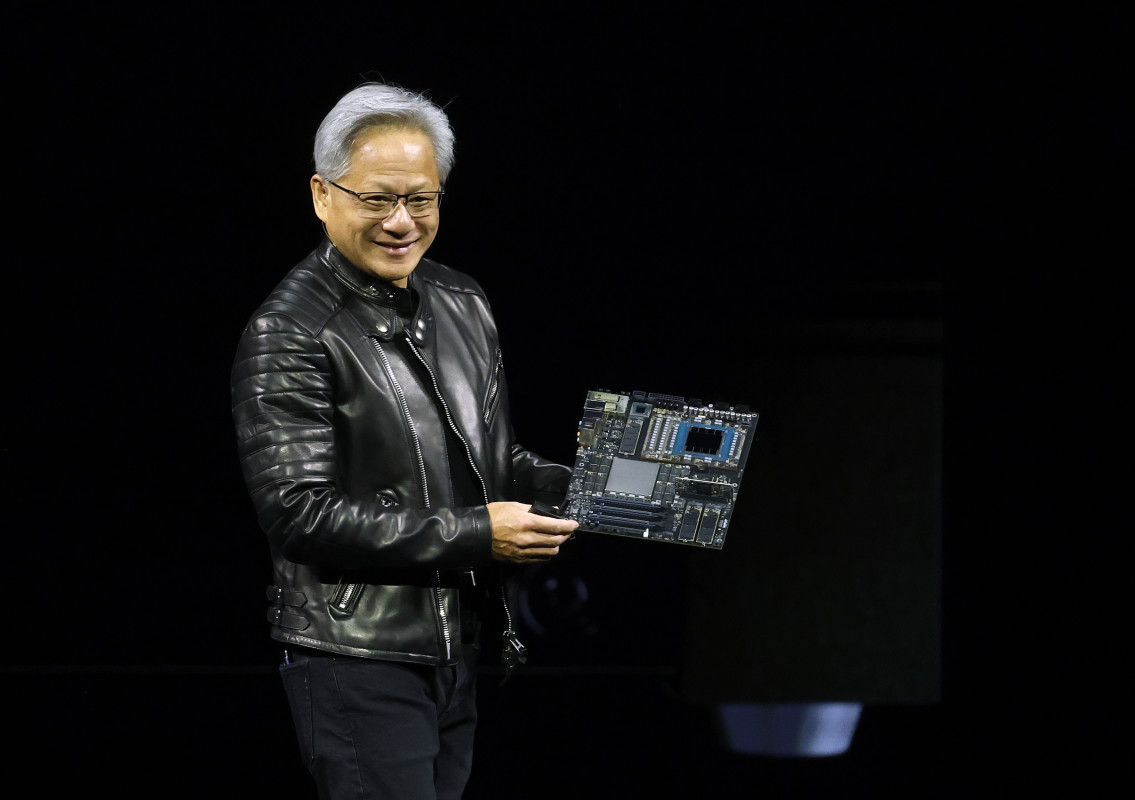

Nvidia: Central to Wall Street’s 2026 Thesis

Among the various companies, Nvidia stands out as a focal point for the bullish sentiment. The firm meets several critical expectations outlined in the optimistic forecasts, such as anticipated earnings growth, robust AI spending, and high valuations. This positions Nvidia as an “anchor stock” within the broader market narrative. As Wall Street strategists consider the potential for 2026, the recurring question looms: Will the momentum in AI continue, or will it falter, causing market disruptions?

The consensus call among analysts hinges on several foundational elements. They agree that earnings must grow sufficiently to justify current prices, interest rates should not exacerbate financial conditions, and AI expenditures must remain strong. Furthermore, current market leaders—primarily large technology firms—must maintain their positions. If these pillars hold firm, analysts suggest that the S&P 500 could achieve a mid-to-high single-digit return in 2026.

Investment Strategies Amid Market Optimism

Investors are encouraged to adopt a risk management mindset, focusing on their betting strategies and recognizing indicators that could signal a shift in market dynamics. This approach emphasizes the need for vigilance, especially concerning Nvidia’s performance which serves as a barometer for the overall market sentiment.

Analysts recommend that investors track the disparity between AI spending and AI hype. As the narrative surrounding AI continues to attract attention, it is essential to distinguish between actual demand—characterized by consistent orders and deployments—and mere narrative demand, which often relies on significant media coverage without substantive results. Nvidia’s management insights will play a crucial role in gauging whether growth is sustainable or if it reflects short-term enthusiasm.

Valuation also poses potential challenges; analysts caution that markets may not be adequately priced for “good” outcomes, but rather for “great” ones. Consequently, even a company like Nvidia, which consistently excels, could see its stock decline if market expectations shift downward.

Market breadth is another critical indicator for investors. A healthy bull market typically features widespread participation across various sectors. If Nvidia rises while other stocks stagnate, it may indicate underlying weaknesses in the broader market. Therefore, consistent performance from Nvidia coupled with engagement from other market segments will be crucial for sustaining positive momentum.

Investors should prepare for volatility, even in an optimistic landscape. Potential disruptions could arise from Federal Reserve actions, fluctuations in earnings guidance, geopolitical tensions, or shifts in public sentiment surrounding AI. Understanding that the anticipated trajectory may not unfold perfectly is vital for maintaining a balanced perspective.

In conclusion, while Wall Street’s rare unified call for optimism in 2026 presents a compelling narrative, it is essential for investors to remain proactive and adaptable. Recognizing Nvidia’s role as a key indicator and implementing robust investment strategies can help navigate the complexities of the market ahead. This approach not only positions investors to capitalize on potential gains but also mitigates the risks associated with unforeseen market shifts.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi at Mānoa Joins $25.6M AI Initiative for Disaster Monitoring

-

Health2 months ago

Health2 months agoNew Gel Offers Hope for Regrowing Tooth Enamel in Dentistry

-

Science2 months ago

Science2 months agoALMA Discovers Companion Orbiting Red Giant Star π 1 Gruis

-

Lifestyle1 month ago

Lifestyle1 month agoPark Jung Min’s Endearing Moment with Hwasa Steals Show at Awards

-

Science3 months ago

Science3 months agoIROS 2025 to Showcase Cutting-Edge Robotics Innovations in China

-

Lifestyle3 months ago

Lifestyle3 months agoStone Island’s Logo Worn by Extremists Sparks Brand Dilemma

-

Lifestyle2 months ago

Lifestyle2 months agoSampson County Celebrates Susie Faison’s 100th Birthday Milestone

-

Health3 months ago

Health3 months agoStartup Liberate Bio Secures $31 Million for Next-Gen Therapies

-

Lifestyle3 months ago

Lifestyle3 months agoMary Morgan Jackson Crowned Little Miss National Peanut Festival 2025

-

Science3 months ago

Science3 months agoArizona State University Transforms Programming Education Approach

-

Science2 months ago

Science2 months agoInterstellar Comet 3I/ATLAS Approaches Sun, No Threat to Earth

-

Health3 months ago

Health3 months agoTop Hyaluronic Acid Serums for Radiant Skin in 2025